Any Person operating under or required to operate under a license, registration, charter, certificate, permit, accreditation or similar authorization under the Banking Law, the Insurance Law or the Financial Services Law.

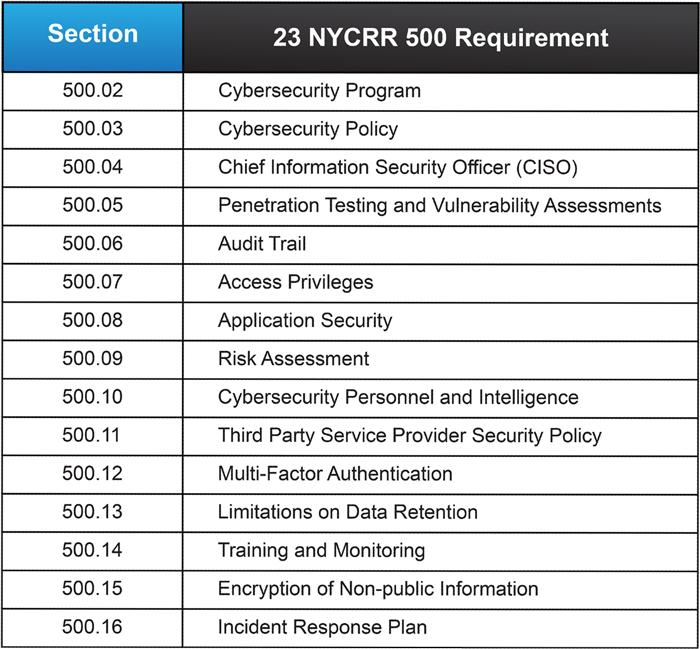

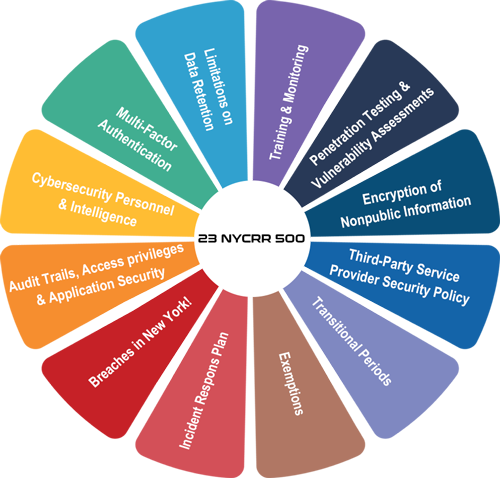

ecfirst is prepared to assist organizations move swiftly and urgently to establish a credible cybersecurity program that addresses 23 NYCRR 500 requirements.